Strengthening Leadership Without Disruption: The Strategic CEO Advisor Approach

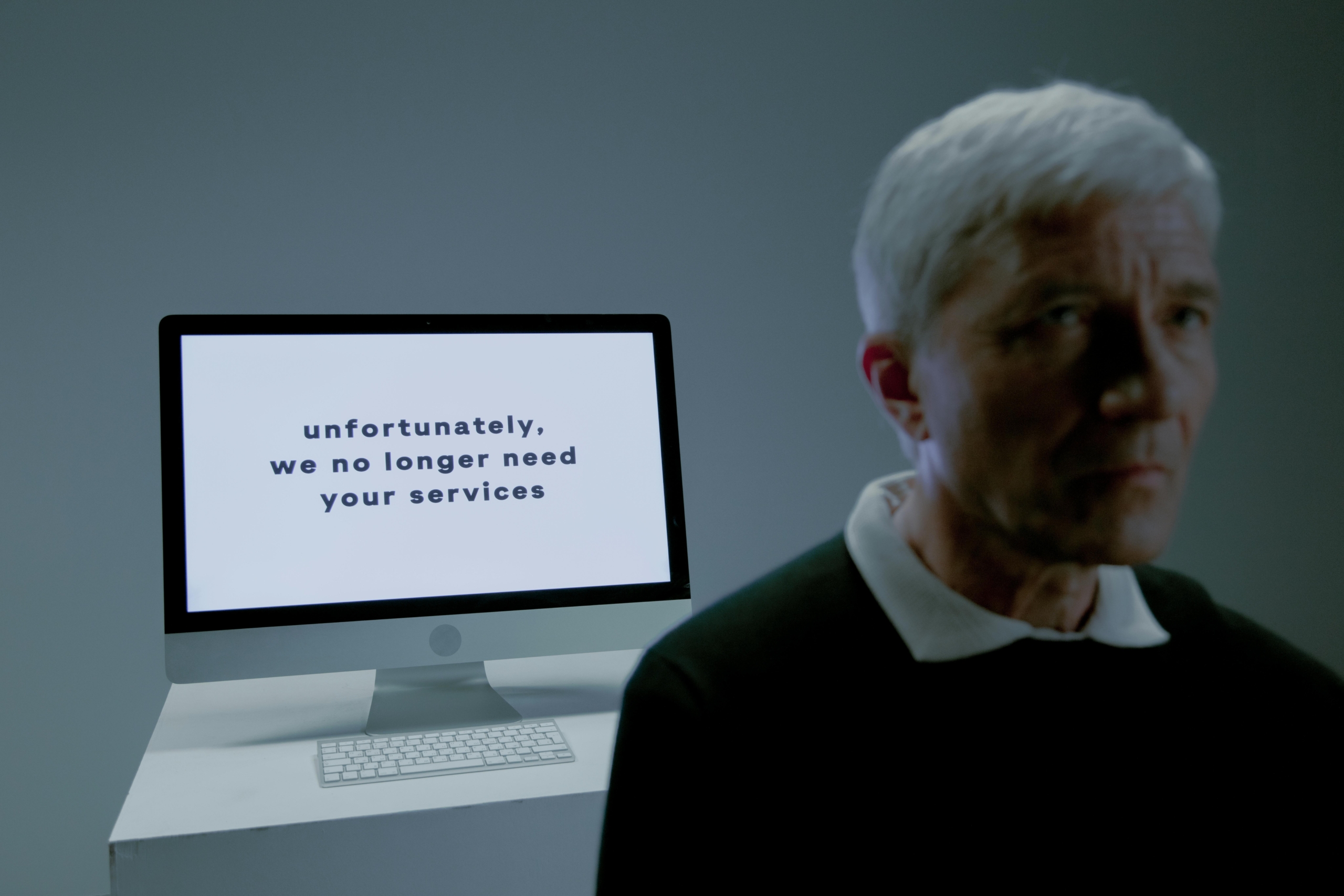

Rethinking CEO Replacement

Replacing a CEO is among the most consequential decisions a board or investor can make. While sometimes necessary, it’s a path fraught with risks: operational disruption, cultural upheaval, and the uncertainty of new leadership integration. For mid-market companies, especially those backed by private equity or specialist lenders, such transitions can stall momentum and erode value.

But what if, instead of replacement, there’s a more effective alternative? One that reinforces existing leadership, addresses performance gaps, and maintains organisational stability.

Enter the Strategic CEO Advisor

Unlike traditional coaching models that often focus on personal development or abstract frameworks, the Strategic CEO Advisor offers hands-on, operationally grounded support. Drawing from real-world executive experience, this role provides CEOs with a trusted partner to navigate complex challenges, drive performance, and align with stakeholder expectations.

This isn’t about mentorship or periodic check-ins. It’s about embedding alongside the CEO to offer actionable insights, facilitate critical decisions, and ensure the leadership remains resilient and effective.

Why Opt for Strategic Advisory Over Replacement?

-

Preserve Organisational Continuity: Maintaining the existing CEO avoids the disruptions associated with leadership changes, ensuring that company culture and strategic initiatives remain intact.

-

Accelerate Performance Improvements: With targeted support, CEOs can quickly address areas of concern, from operational inefficiencies to strategic misalignments, without the learning curve a new leader would face.

-

Enhance Stakeholder Confidence: Demonstrating a commitment to strengthening current leadership can reassure investors, employees, and partners, showcasing proactive governance.

-

Cost and Time Efficiency: Avoiding the lengthy and expensive process of executive search and onboarding allows for immediate focus on business priorities.

The Role in Action

Consider a scenario: A PE-backed manufacturing firm faces declining margins and internal discord. The board contemplates a leadership change but recognises the CEO’s deep industry knowledge and past successes.

By introducing a Strategic CEO Advisor, the company provides the CEO with:

-

Operational Insight: Identifying root causes of margin erosion and implementing corrective measures.

-

Leadership Support: Addressing internal team dynamics and fostering a cohesive executive team.

-

Strategic Alignment: Ensuring that the company’s direction aligns with investor expectations and market realities.

Over time, the CEO regains footing, the company’s performance stabilises, and the contemplated leadership change becomes unnecessary.

Selecting the Right Advisor

The effectiveness of this approach hinges on the advisor’s experience and compatibility. Ideal candidates are seasoned executives with a track record of navigating similar challenges. They should possess:

-

Operational Expertise: A deep understanding of business mechanics, not just theoretical knowledge.

-

Strategic Acumen: The ability to align day-to-day operations with long-term objectives.

-

Discretion and Trustworthiness: Ensuring that their involvement bolsters, rather than undermines, the CEO’s authority.

Conclusion

In the dynamic landscape of mid-market, PE, and lender-backed businesses, leadership challenges are inevitable. However, replacing a CEO isn’t always the optimal solution. By leveraging the expertise of a Strategic CEO Advisor, organisations can reinforce existing leadership, drive performance, and navigate complexities without the upheaval of a leadership change.

For boards and investors seeking to support their CEOs proactively, this approach offers a balanced path forward, combining stability with strategic enhancement.

About the Author

Trevor is the Managing Partner of NorthCo, a fellow of the Institute of the Motor Industry and a member of the Institute of Interim Management. Trevor is a respected C-Suite leader, Chairman and professional Interim Leader. For over a decade, he has provided interim leadership solutions to private equity, venture capital, and asset-backed firms. Whether it’s to stabilise a business during a turbulent trading period, fill a temporary skills gap or support a management team to navigate challenging situations, Trevor’s wealth of experience and proven track record in delivering value creation and retention plans demonstrate his ability to lead and support operational management teams effectively. To find out more about his LinkedIn profile and read what others say about Trevor.