The Urgency of Engaging Interim Leaders for Portfolio Managers

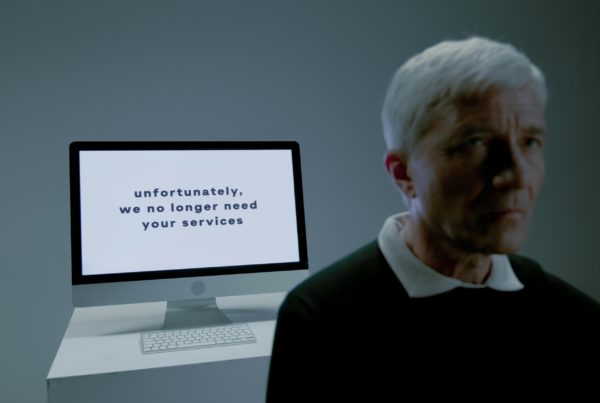

Private equity portfolio managers bear a tremendous responsibility regarding their investments. The value of their portfolios can fluctuate significantly, and businesses under their purview may face daunting operational challenges in times of crisis. Recognising the importance of swift action and strategic intervention, private equity portfolio managers must engage with interim leaders before their investment becomes economically irrecoverable.

The Imperative for Timely Action

When a business within a private equity portfolio finds itself in dire straits, a timely response is of the essence. Operational hurdles, financial constraints, and the need for restructuring can quickly overwhelm the existing management team. To address these challenges effectively, private equity portfolio managers must act decisively, and one powerful tool at their disposal is the interim leader.

Empowering Existing Leadership

An interim leader adds a layer of leadership bandwidth that can be a game-changer for struggling businesses. They serve as a force multiplier, enabling the incumbent management team to navigate the intricate path of business turnaround more efficiently. By shouldering a portion of the operational responsibilities, they grant the CEO and other leaders the breathing space to concentrate on strategic planning and recovery efforts.

Leveraging Specialised Expertise

Interim leaders are not just placeholders; they are seasoned professionals with a wealth of experience and operational expertise. Their role extends beyond managing daily operations to optimising them. This means identifying inefficiencies, implementing process improvements, and streamlining the organisation to make it more agile and responsive to market changes. This expertise is a lifeline for private equity portfolio managers to help their investments regain their competitive edge.

Balancing Efficiency and Strategy

The beauty of an interim leader lies in their ability to address operational efficiency and strategic financial management simultaneously. While they tackle the daily intricacies, the CEO and other leaders can channel their efforts towards stabilising the business’s financial health, exploring new revenue streams, and developing a comprehensive turnaround plan. This dual focus ensures that the business is efficiently managed and on a clear path towards sustainable recovery.

Enhancing Overall Efficiency and Productivity

The presence of an interim leader can significantly enhance the overall efficiency and productivity of an organisation in crisis. Their operational prowess enables faster decision-making, improved resource allocation, and the removal of bottlenecks that may have been impeding progress. Private equity portfolio managers must recognise the value of this heightened efficiency in securing the success of their investments.

Conclusion

In the world of private equity, every investment is a calculated risk. When turbulent times strike and businesses within a portfolio face upheaval, interim leaders can be the critical intervention that preserves the investment’s value. By providing additional leadership bandwidth, offering operational expertise, and enabling a balanced focus on efficiency and strategy, interim leaders accelerate the path to recovery. Therefore, private equity portfolio managers should act faster in engaging with interim leaders to steer their investments towards calmer waters and sustainable growth. Failure to do so may result in investments becoming economically irreparable, a scenario that can be avoided through proactive intervention.

Trevor is a member of the Institute of Interim Management – My Institute of Interim Management Portfolio.

About the Author

Trevor is a fellow of the Institute of the Motor Industry and a member of the Institute of Interim Management, is a respected C-Suite leader and professional Interim Leader. For over a decade, he has provided interim leadership solutions to private equity, venture capital, and asset-backed firms. Whether it’s to stabilise a business during a turbulent trading period, fill a temporary skills gap or support a management team to navigate challenging situations, Trevor’s wealth of experience and proven track record in delivering value creation and retention plans demonstrate his ability to lead and support operational management teams effectively. To find out more about his approach, explore his LinkedIn profile and read what others say about Trevor.