Note on Confidentiality

Disclaimer: “MediCorp Manufacturing Ltd” is a fictitious name used to maintain confidentiality. However, the content of this case study is based on actual events and experiences encountered during an operational assessment for a private equity firm. References are available upon request.

Case Study: Operational Assessment of MediCorp Manufacturing Ltd

Background

After an initial investment in MediCorp Manufacturing Ltd, a mid-sized manufacturing and distribution business, the private equity (PE) firm noticed a troubling trend: the company was stalling in its growth, and the investment thesis, which had promised significant returns, was not being realised.

The company’s banker was also growing concerned, particularly as the business was forecasting that it would not meet its banking covenants. Considering these developments, the PE firm recognised the need for an operational assessment to uncover the underlying issues and to develop a strategic plan to get back on track.

As a by-product of the findings within the report, the PE director and I recognised the importance of meeting with the bank. To address the bank’s concerns, I accompanied the PE firm’s portfolio director to meet with them. During this meeting, I reassured them that if we implemented the necessary changes based on my findings, we could stabilise the business and get back on the right track. This engagement successfully settled the bank’s concerns, reinforcing their confidence in our ability to address the challenges.

Objective

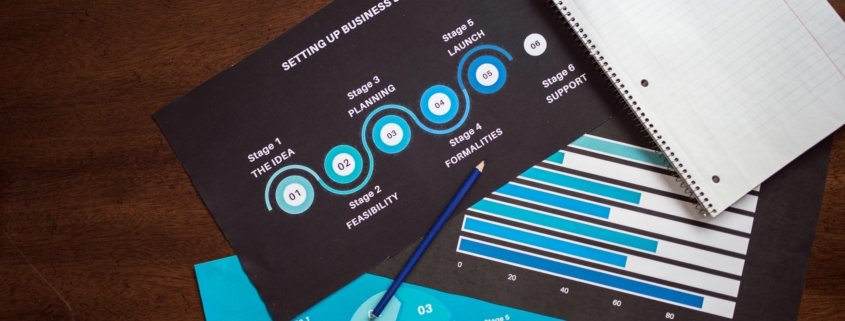

The primary aim of the operational assessment was to identify the reasons behind the stall in growth and the failure to meet the investment thesis.

The evaluation focused on:

- Evaluating the management team’s effectiveness and alignment with the business plan.

- Assessing operational capacity and efficiency.

- Identifying cash flow risks and developing mitigation strategies.

- Reviewing succession plans for key personnel.

- Understanding the company culture and identifying cultural architects.

Assessment Process

The operational assessment was structured into several critical components:

- Management Team Evaluation:

- Leadership Capability: Analysed the management team’s experience, skills, and track record in executing the business strategy. Interviews with team members helped gauge their commitment and clarity of vision.

- Business Plan Alignment: Reviewed the existing business plan to determine if it was still relevant and whether the management team was effectively executing it.

- Operational Capacity Review:

- Resource Assessment: Evaluated the operational infrastructure, including technology, workforce, and processes, to determine whether the company could scale operations and meet market demand.

- Process Efficiency: Conducted a detailed audit of operational processes to identify inefficiencies, bottlenecks, and improvement areas that might hinder growth.

- Financial Analysis:

- Cash Flow Assessment: Reviewed historical cash flow data to identify discrepancies and potential risks affecting the company’s financial health.

- Mitigation Strategies: Developed recommendations to improve cash flow management, including better credit control measures and cost reduction tactics.

- Succession Planning:

- Critical Personnel Identification: Identified crucial roles within the company that were essential for operational continuity and growth.

- Readiness for Transition: Assessed the current state of succession planning, focusing on whether suitable candidates could step into critical roles if needed.

- Cultural Assessment:

- Cultural Health: Evaluated the organisational culture to understand how it was affecting performance and employee morale.

- Cultural Architects: Identified key individuals who significantly shaped the company culture and whose retention was vital for maintaining organisational knowledge and motivation.

Practical Action-Oriented Report

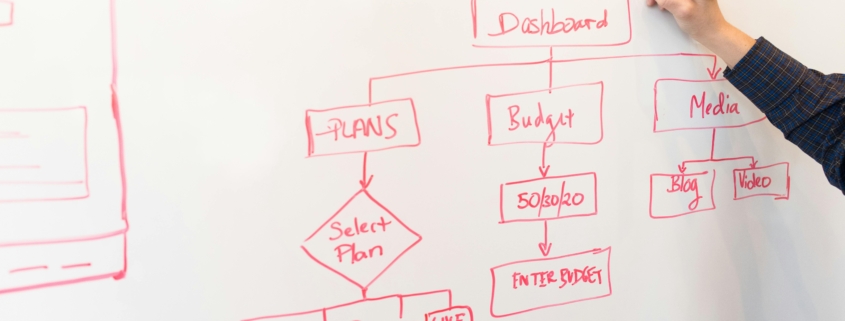

The output of the operational assessment was an efficient, action-oriented report that outlined clear steps for improvement and provided a roadmap for recovery. This report was a foundational document, guiding the interim leadership team to realign the company with its strategic goals.

Findings

Strengths

- Experienced Leadership: The management team possessed substantial industry experience and a clear understanding of the manufacturing landscape, which should have positioned the company for success.

- Operational Framework: Existing processes were generally efficient, indicating a solid operational foundation that could be leveraged for growth.

Weaknesses

- Ineffective Finance Team: A fragile finance team was found to be ill-equipped to manage cash flow and control spending. This lack of financial oversight posed significant risks to the company’s sustainability.

- Founder and CEO’s Absence: Despite initial perceptions that the founder and CEO was a driving force behind the business, it became clear that he was largely absent, leaving the middle management team to navigate operations. His lack of presence contributed to uncertainty and inconsistency within the leadership structure.

- Demotivated Leadership: The founder’s demotivation negatively impacted the management team. Although he spoke knowledgeably about the business, he did not put in the necessary effort or attendance to inspire others. His disengagement fostered a culture of apathy, leading to a decline in morale across the organisation.

- Misguided Recruitment Strategy: The CEO had ostensibly recruited a large and expensive management team to compensate for his shortcomings. However, this decision proved counterproductive, as the recruited individuals were not given the necessary direction or support to thrive, further complicating operational challenges.

Risks

- Dependency on Key Individuals: The company’s reliance on a few key personnel posed a significant risk, as their potential departure could further exacerbate operational challenges.

- Cash Flow Vulnerabilities: Historical analysis showed signs of cash flow strain, with several factors contributing to unpredictable financial performance.

Opportunities

- Market Expansion: The assessment identified untapped market segments that could provide avenues for growth, suggesting that with proper execution, there was still significant potential to realise the original investment thesis.

- Process Optimisation: Streamlining operational processes could lead to improved efficiency and cost savings, facilitating quicker response times to market demands.

Original Investment Thesis

The original investment thesis for MediCorp Manufacturing Ltd was sound, based on solid market growth projections and the company’s potential operational capabilities. However, these capabilities were not aligned with reality, primarily due to leadership shortcomings and operational mismanagement. Had the operational capacity been what the PE firm had initially believed, the company would likely have been on a much different trajectory.

Interim Leadership and Implementation

Trevor was asked to support and coach the CEO in implementing a business improvement plan. However, the PE firm and the CEO faced significant challenges due to other shareholder matters outside of our involvement. Consequently, the CEO stepped down, and Trevor was subsequently asked to take over as the interim CEO.

In this role, Trevor enacted the plan, stabilised the business, and appointed a new permanent CEO. This transition was crucial in restoring confidence among the team and aligning the company’s operations with its strategic goals.

Results

With these changes, MediCorp Manufacturing Ltd is now back on track and thriving. The company has regained momentum in its growth trajectory and established a healthier organisational culture and operational efficiency. The new leadership team has successfully aligned the company’s operational capabilities with the original investment thesis, demonstrating the potential that initially attracted the PE firm’s investment.

Conclusion

The operational assessment of MediCorp Manufacturing Ltd highlighted several critical areas that needed attention to reverse the trend of stagnation and better align the company with the original investment thesis.

Although the assessment was initiated after the initial investment, the findings underscored the importance of conducting similar evaluations earlier in the investment process.

Importantly, the assessment also reassured the bank of the steps to stabilise the business, especially given the company’s forecast that it would not meet its banking covenants.

The insights gained provided a roadmap for the PE firm to support MediCorp Manufacturing Ltd in overcoming its challenges and leveraging its strengths to achieve sustainable growth.

This experience is a valuable lesson for future investments, reinforcing the necessity of thorough operational assessments to ensure alignment with strategic goals and maximise the potential for successful outcomes.