Leadership That Inspires Loyalty: Keeping Your Team Motivated in Uncertain Times

Leadership That Inspires Loyalty: Keeping Your Team Motivated in Uncertain Times

In challenging times, leadership is tested most. Teams look to their leaders for guidance, reassurance, and inspiration. How you lead during periods of uncertainty can make the difference between a disengaged workforce and one that is energised and committed to success. Inspiring loyalty isn’t about grand gestures—it’s about consistent actions that show you value and support your people.

Here’s how to lead in a way that earns trust and motivates your team when it matters most.

1. Communicate with Clarity and Transparency

Key Principle: People trust leaders who are honest, clear, and consistent in their messaging.

- Be Open About Challenges: Share the realities of the situation while highlighting your plan to address them.

- Listen Actively: Create channels for employees to voice concerns and ideas, showing you value their input.

- Repeat Key Messages: Consistency breeds confidence. Ensure your team knows the priorities and how their work contributes to the bigger picture.

Action Step: Hold a team meeting this week to update your employees on key priorities and invite questions to clarify concerns.

2. Show Empathy and Understanding

Key Principle: Loyalty is built when people feel seen, heard, and understood.

- Acknowledge Their Challenges: Recognise the pressures your employees may be facing both at work and in their personal lives.

- Provide Flexibility: Adapt to individual needs where possible, such as offering flexible work hours or mental health resources.

- Celebrate Small Wins: Recognise and appreciate efforts, even in small ways, to boost morale and show your team their work matters.

Action Step: Send a personalised message or publicly acknowledge an individual or team effort that has made a positive impact this week.

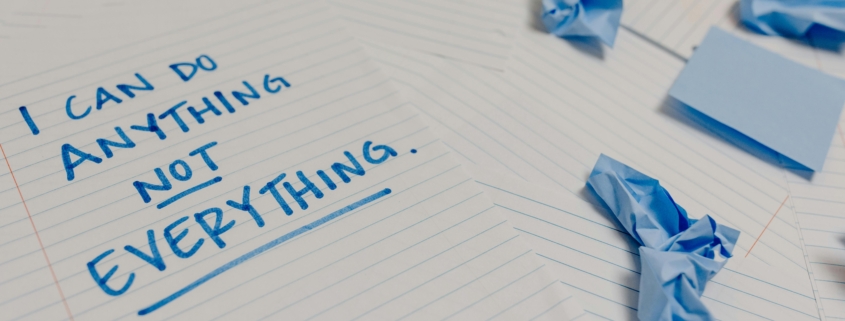

3. Empower Ownership and Autonomy

Key Principle: People are more engaged when they feel trusted to make decisions and take responsibility.

- Delegate Meaningfully: Give team members ownership of projects or initiatives, allowing them to take the lead.

- Encourage Problem-Solving: Involve your team in finding solutions to challenges, empowering them to take action.

- Support Without Micromanaging: Be available to guide and assist, but trust your team to execute their tasks independently.

Action Step: Identify one project this week where you can delegate more responsibility and encourage independent decision-making.

4. Provide Growth Opportunities

Key Principle: Investing in your team’s development shows you care about their future, not just the organisation’s immediate needs.

- Offer Training and Upskilling: Provide opportunities for employees to learn new skills or take on stretch assignments.

- Create a Path for Advancement: Clearly outline potential career growth paths, even during tough times.

- Mentor and Coach: Spend time supporting individual team members in their personal and professional development.

Action Step: Organise a training session or workshop on a skill that will benefit both your team and the organisation.

5. Lead by Example

Key Principle: Actions speak louder than words. Demonstrate the behaviours you want your team to emulate.

- Model Resilience: Show calmness and determination in the face of challenges.

- Be Visible and Approachable: Make an effort to connect with your team regularly, showing you’re in the trenches with them.

- Admit Mistakes: Being honest about your own shortcomings builds trust and shows humility.

Action Step: Identify one specific behaviour you want your team to adopt and model it consistently this week.

Positioning Your Team for Success

Leadership that inspires loyalty isn’t about control—it’s about connection. By communicating openly, showing empathy, empowering your team, fostering growth, and leading by example, you create an environment where people feel valued and motivated to give their best.

In uncertain times, your ability to inspire loyalty and engagement will not only steady the ship but also position your organisation to emerge stronger.

Prepare to move, Trevor